How to Track Expenses and Profits for Your Online Store: A Beginner’s Accounting Guide

You’ve launched your shop. Sales are rolling in, and your products are gaining traction. But while growing...

How to Handle Taxes & Compliance in Multiple Jurisdictions for Subscription & Rental Businesses

As your subscription-based business or rental company expands, borders become blurry. But tax authorities don’t see it...

6 Ways Subscription Businesses Can Optimize Cash Flow

Compared to other business models, subscription-based businesses tend to have higher retention rates. Traditional one-time-purchase businesses rely...

Maximizing Your Business Vehicle Deductions Without Raising Red Flags

Business vehicle deductions are one of the most common ways for small businesses to reduce taxable income. ...

Teletherapy and Taxes: How to Prepare Financial Records Year-Round

Telehealth visits have become more popular in recent years. In 2023, 58% of all telehealth appointments were...

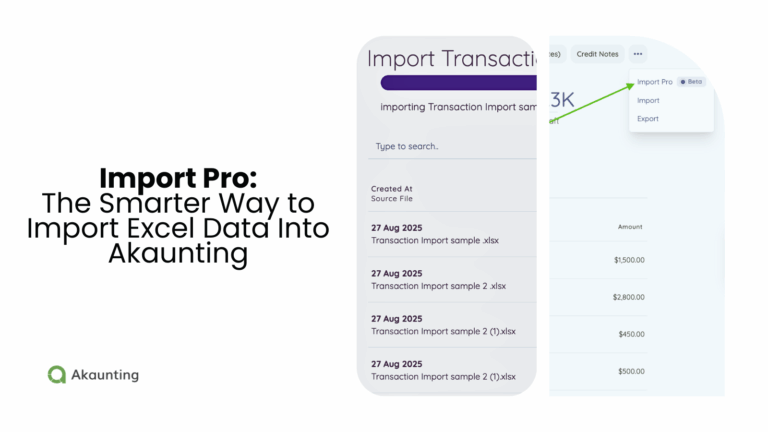

Import Pro: The Smarter Way to Import Excel Data Into Akaunting

Import Pro gives you a smarter, faster, and more reliable way to move your data into Akaunting,...

Accounting for Multi-Asset Trading: Keeping Clean Books for Crypto, Forex, and Commodities

If you trade crypto, forex, and commodities as part of a broader investment strategy, your accounting needs...

How to Set Up an Invoicing System for Your Telehealth Practice

Telehealth has changed how we deliver care — but not always how we bill for it. Many...

Invoicing Best Practices for Private Practice Providers: Virtual and Hybrid Models

Getting the right invoicing system down is one of smartest moves you can make in your private...

The Financial Side of Being a Creator: Tools to Track, Bill, and Budget

Tracking expenses, billing clients, and sticking to a budget isn’t always fun, but it’s essential if you’re...

How to Track Expenses and Profits for Your Online Store: A Beginner’s Accounting Guide

You’ve launched your shop. Sales are rolling in, and your products are gaining traction. But while growing sales look good on paper, they...

How to Handle Taxes & Compliance in Multiple Jurisdictions for Subscription & Rental Businesses

As your subscription-based business or rental company expands, borders become blurry. But tax authorities don’t see it that way. Each jurisdiction has its...

6 Ways Subscription Businesses Can Optimize Cash Flow

Compared to other business models, subscription-based businesses tend to have higher retention rates. Traditional one-time-purchase businesses rely on repeat marketing to get customers...

Maximizing Your Business Vehicle Deductions Without Raising Red Flags

Business vehicle deductions are one of the most common ways for small businesses to reduce taxable income. Every mile, fuel purchase, and eligible...